We've collected the most popular questions received by our generous patrons. Please contact us with any other questions you may have. We're happy to answer them!

RE!NSTITUTE is a 501(c)3 tax-exempt organization and your donation is tax-deductible within the guidelines of U.S. law. Contributions to RE!NSTITUTE will always be tax-deductible. Once you have made your gift, an IRS-compliant tax acknowledgment will be sent to you. To claim a donation as a deduction on your U.S. taxes, please keep your email donation receipt as your official record. We'll send it to you upon the successful completion of your donation.

Please visit our Ways to Give page regarding information on how to give. For any questions please contact our Development Team at development@re-institute.org.

Donor Privacy and Confidentiality - RE!NSTITUTE respects the privacy of our donors. We will add donors to our mailing list unless they request otherwise. We will list any contributions in our publications only with prior written approval from donors. We do not retain credit card numbers. We do not sell, rent, trade or transfer any personal information to any outside organization. If donors have any other questions about donor privacy or wish to update their contact preferences, they can send an email to development@re-institute.org.

See if your employer is listed here or contact your employer’s human resources today, to discover if they offer matching gift fund benefits and how to set it up.

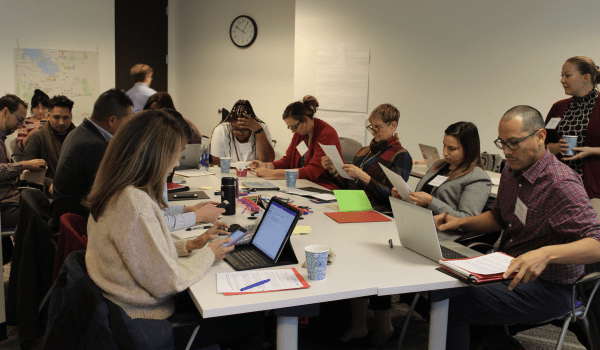

We believe in putting people at the heart of system change.

How we catalyze and cultivate systems transformation.

Discover why equity takes a central role in the work we do within and across systems.